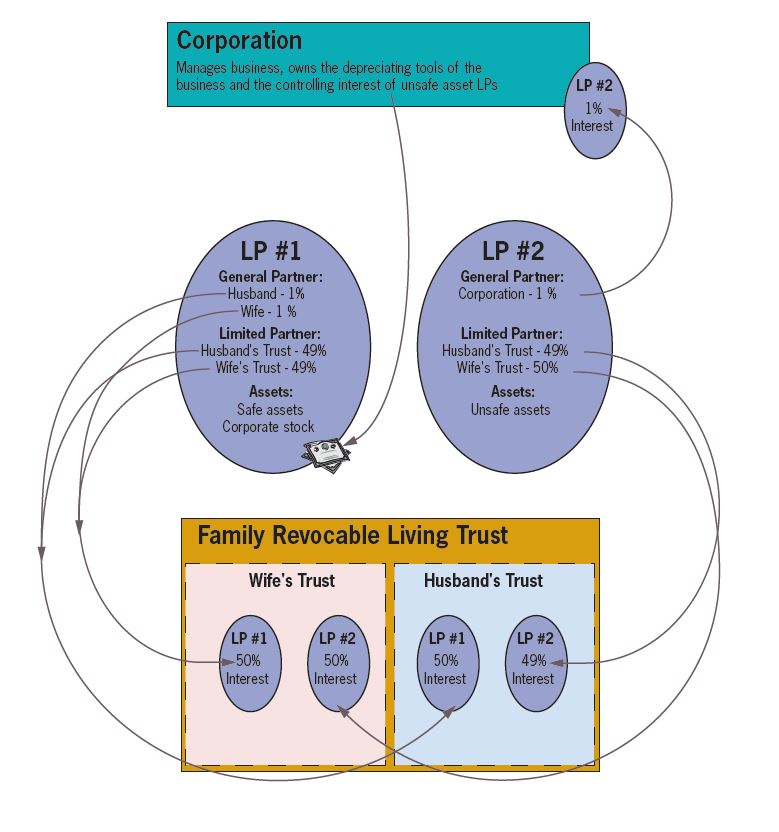

Basic Structure

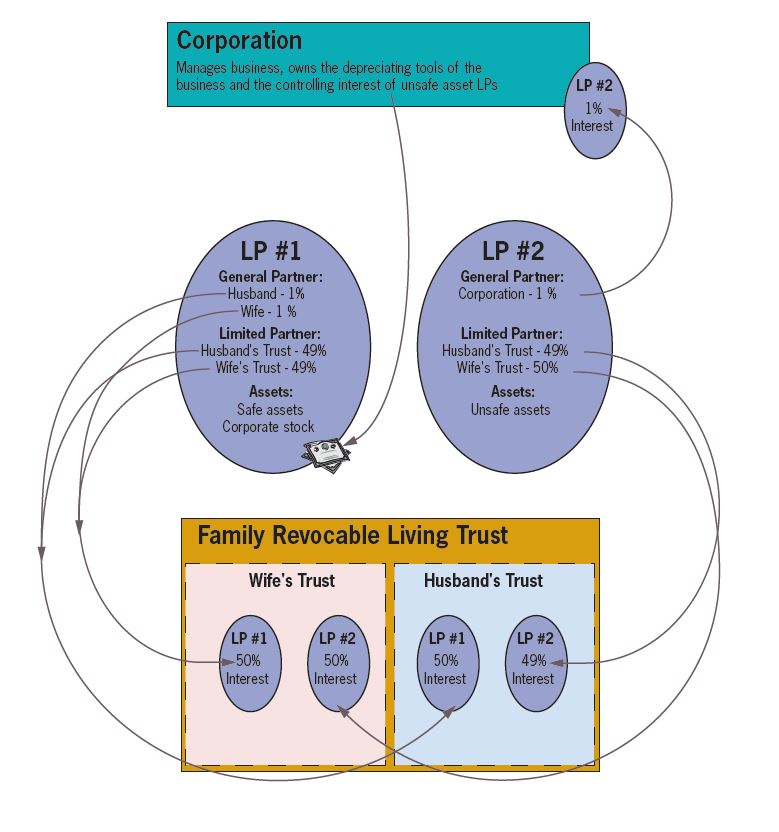

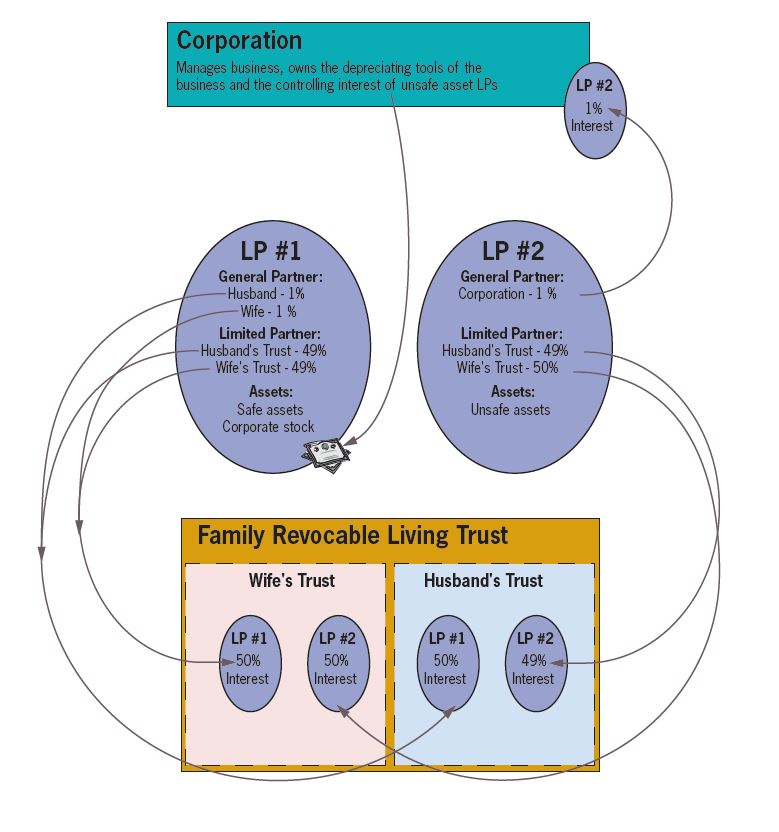

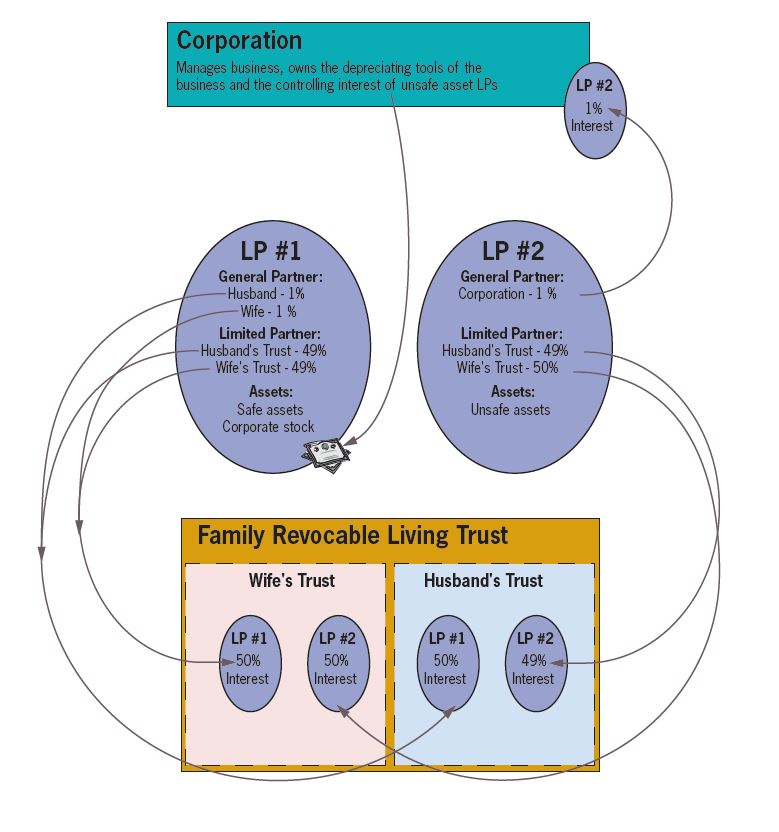

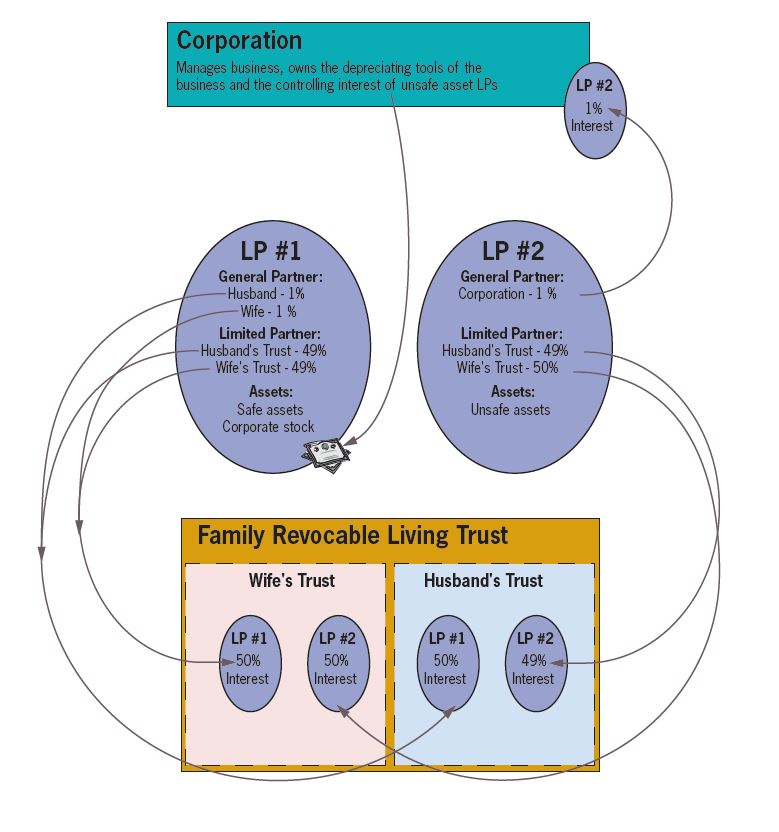

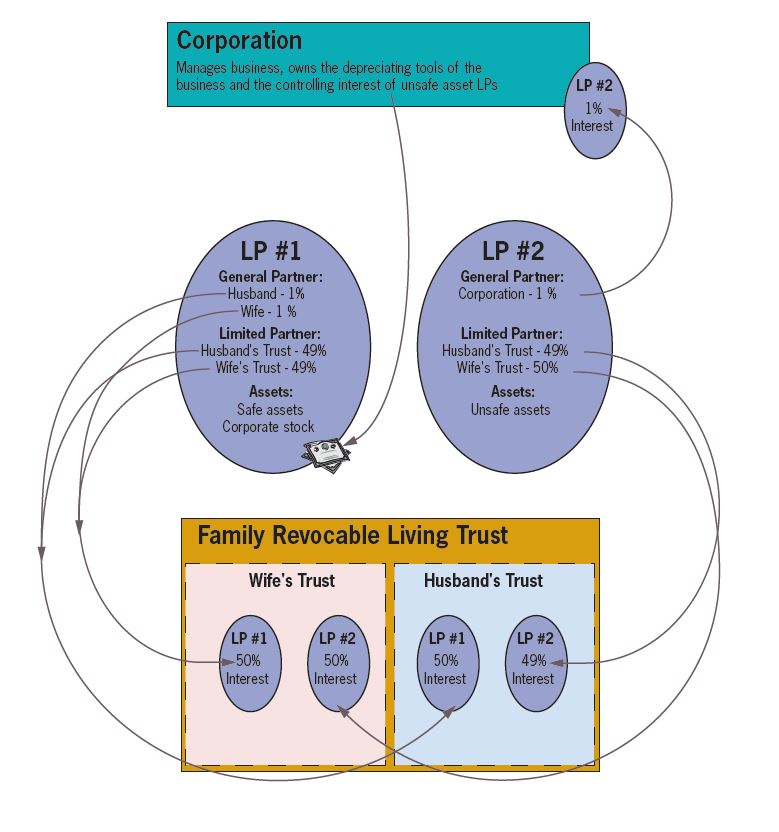

BY Admin | July 2021Management Entity (Usually a Corporation or LLC taxed as a Corporation) – The purpose of the management entity is to reduce the personal income taxes and shield the owners from personal liability. The Corporation owns the depreciating tools of the business, the supplies, and the inventory necessary to operate the…

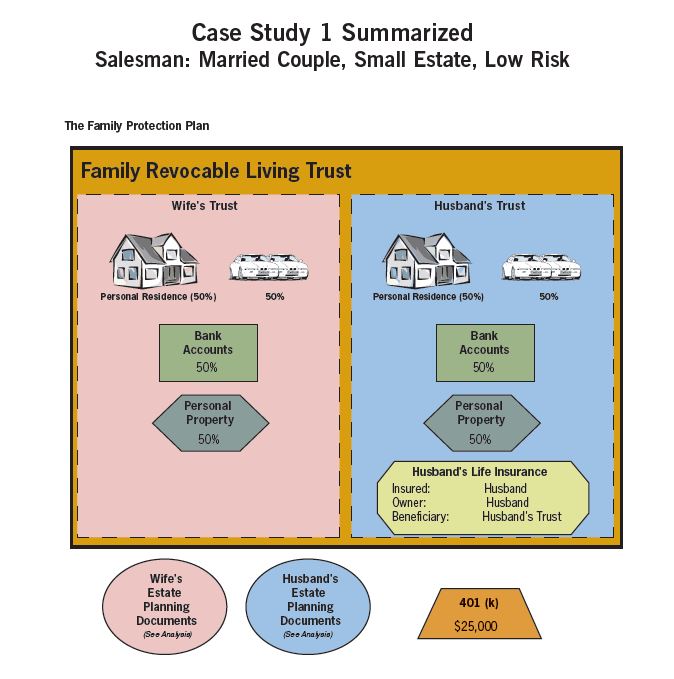

Case Study 1

BY Admin | June 2021Salesman: Married Couple, Small Estate, Low Risk Family Assets: Cash ............................................$5,000 401(k) ................................... $25,000 Home ..............$200,000 Personal Property ...................$20,000 Mortgage .....<$160,000> ........$40,000 Net…

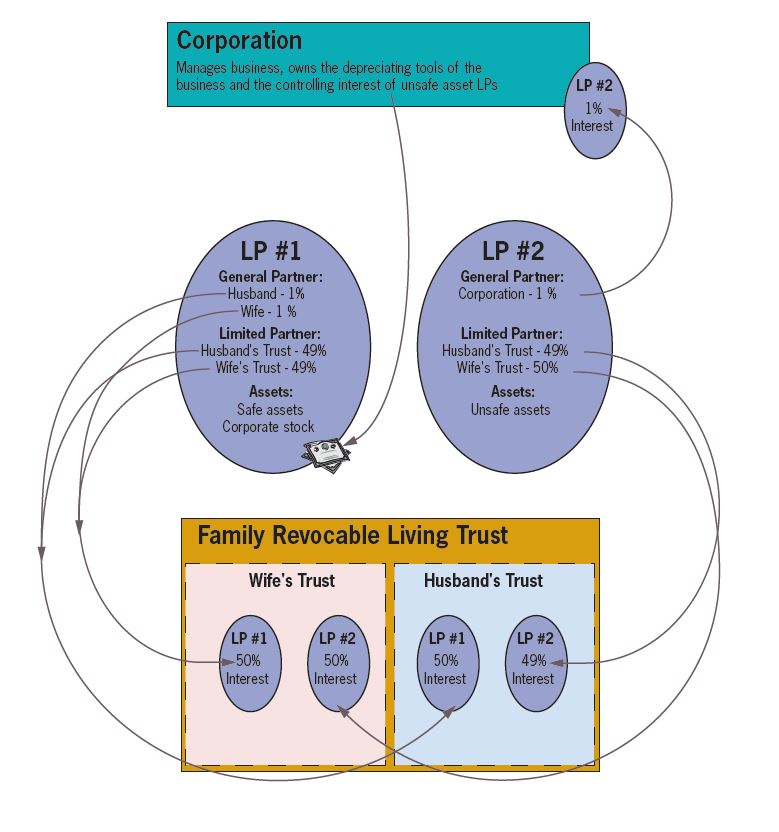

Basic Structure

BY Admin | July 2021Management Entity (Usually a Corporation or LLC taxed as a Corporation) – The purpose of the management entity is to reduce the personal income taxes and shield the owners from personal liability. The Corporation owns the depreciating tools of the business, the supplies, and the inventory necessary to operate the…

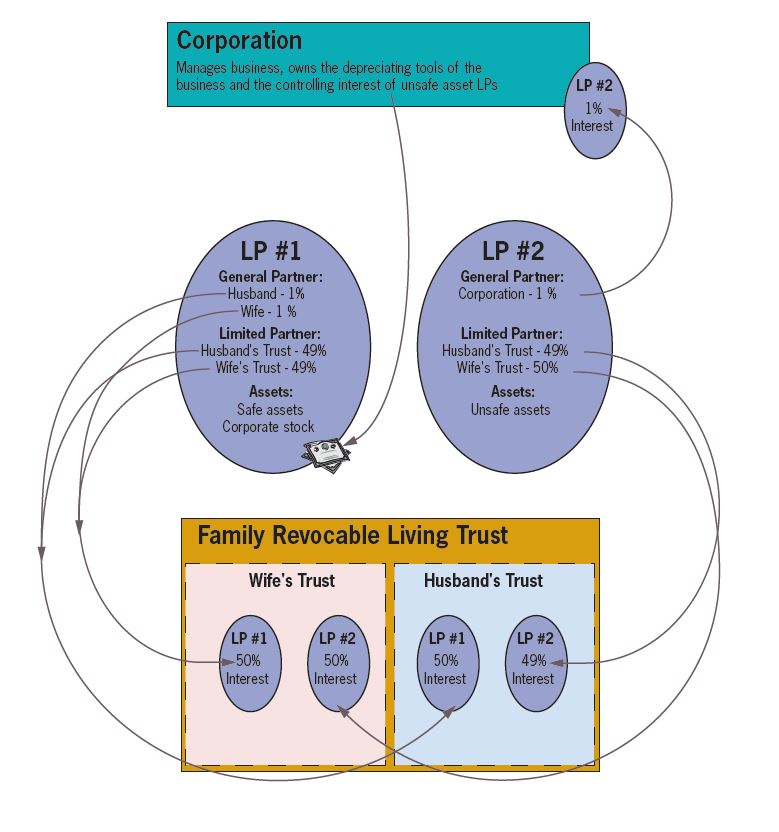

Basic Structure

BY Admin | July 2021Management Entity (Usually a Corporation or LLC taxed as a Corporation) – The purpose of the management entity is to reduce the personal income taxes and shield the owners from personal liability. The Corporation owns the depreciating tools of the business, the supplies, and the inventory necessary to operate the…

Basic Structure

BY Admin | July 2021Management Entity (Usually a Corporation or LLC taxed as a Corporation) – The purpose of the management entity is to reduce the personal income taxes and shield the owners from personal liability. The Corporation owns the depreciating tools of the business, the supplies, and the inventory necessary to operate the…

Basic Structure

BY Admin | July 2021Management Entity (Usually a Corporation or LLC taxed as a Corporation) – The purpose of the management entity is to reduce the personal income taxes and shield the owners from personal liability. The Corporation owns the depreciating tools of the business, the supplies, and the inventory necessary to operate the…

Basic Structure

BY Admin | July 2021Management Entity (Usually a Corporation or LLC taxed as a Corporation) – The purpose of the management entity is to reduce the personal income taxes and shield the owners from personal liability. The Corporation owns the depreciating tools of the business, the supplies, and the inventory necessary to operate the…

Basic Structure

BY Admin | July 2021Management Entity (Usually a Corporation or LLC taxed as a Corporation) – The purpose of the management entity is to reduce the personal income taxes and shield the owners from personal liability. The Corporation owns the depreciating tools of the business, the supplies, and the inventory necessary to operate the…

Basic Structure

BY Admin | July 2021Management Entity (Usually a Corporation or LLC taxed as a Corporation) – The purpose of the management entity is to reduce the personal income taxes and shield the owners from personal liability. The Corporation owns the depreciating tools of the business, the supplies, and the inventory necessary to operate the…