ABOUT US

Protect Wealth

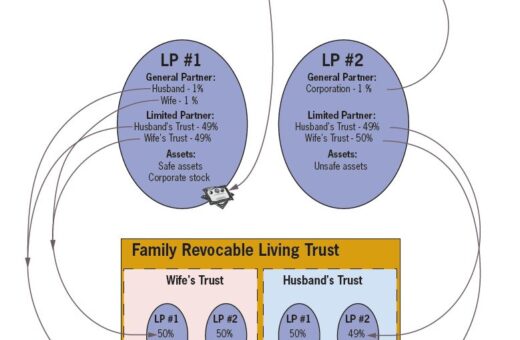

Whether you use a trusted attorney, accountant, or adviser to manage your finances, it pays to understand exactly what is happening with your hard-earned money. Don’t leave the success of your estate plan to someone else. Make sure you know exactly how to protect your assets, reduce taxes and create wealth.

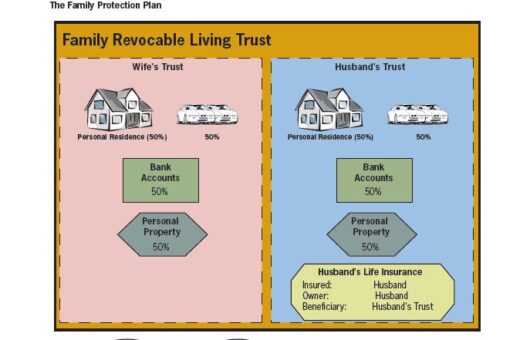

Who needs Protect Wealth Academy? Medical Doctors, Small Business Owners, Real Estate Investors, Dentists, Estate Planning Attorneys, Financial Planners, CPAs and Accountants, Franchisers, Manufacturers, Stock Market Investors, Homeowners, Wealth Managers, and anyone trying to create and protect their wealth! Use an LLC, Corporation, Living Trust, or other entity to protect what matters most, and let us know how we can help!