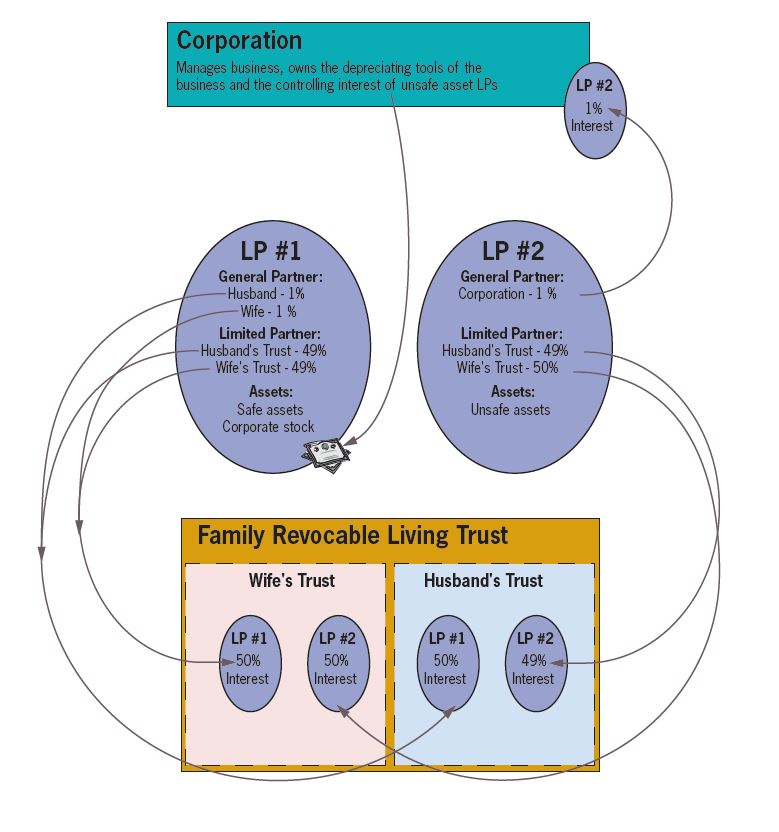

Management Entity (Usually a Corporation or LLC taxed as a Corporation) – The purpose of the management entity is to reduce the personal income taxes and shield the owners from personal liability. The Corporation owns the depreciating tools of the business, the supplies, and the inventory necessary to operate the business. It may also own the controlling interest in Family Limited Partnerships.

FLP #1 – Family Limited Partnership #1 owns the family’s safe asset and the stock of the Corporation. (Note: Stock in an S-Corp or in a Professional Corporation must be owned individually and can not be owned by a partnership.) Because there is no inherent risk in owning safe assets, the husband and wife will generally be the General Partners. They are also Limited Partners because they initially contributed the assets of the partnership. They may choose to gift interests of the FLP to family members if there are income tax or estate tax planning advantages.

FLP #2 – Family Limited Partnership #2 owns the family’s dangerous assets. Because the General Partner has liability for the events within a partnership and because there is an inherent risk in simply owning these assets, the Corporation serves as the General Partner. Generally, the husband and wife are the Limited Partners since they probably contributed the assets to the partnership. Again, they may choose to gift interests to family members if there are tax advantages but must consider the IRS guidelines for gifting.

Family Revocable Living Trust – The principal purpose of this trust is to provide for a systematic distribution of family assets upon the death of the individual while avoiding the probate process. By completing the Family Trust document, two separate trusts are created, the Husband’s Trust and the Wife’s Trust. Assets may be assigned and/or titled in the name of either spouse’s trust, or they may be titled in the name of the Family Trust, which splits the assets 50/50 between the two trusts.

(Additional details on funding and conveying interests to the trust can be found in our Asset Protection Handbook)

Basis Structure Summarized

Management Entity (Usually a corporation or LLC taxed as a corporation)

- General Purposes – Reduce income taxes and shield the owners from personal liability

- Function – Manage the assets and operates the business

- Owns – Depreciating tools required to operate the business and the controlling interest in unsafe entities

- Owned by – Stockholders (usually the parents)

- Controlled by – Directors (usually the parents)

Ownership Entity (Usually a Limited Partnership or LLC)

-

- General purposes – Protect assets, spread income, and reduce the size of the estate

- Function – Hold title to assets

- Owns – Appreciating assets such as real estate, equipment, and investments

- Owned by – Whoever contributed the assets (usually the parents)

- Controlled by – The General Partner

- For safe assets – Usually the parents

- For dangerous assets – Usually a corporation or LLC

Revocable Living Trust

- General Purpose – Avoid Probate

- Function – Provide for a systematic distribution of family assets upon the death of the individual

- Owns – Interests in the ownership entities and all personal property (essentially everything the family owns will be in the trust)

- Owned by – Trustors (usually the parents)

- Controlled by – Trustors create the rules and guidelines of the trust, the Trustees carry out the wishes of the Trustors