Salesman: Married Couple, Small Estate, Low Risk

Family Assets:

Cash ……………………………………..$5,000 401(k) …………………………….. $25,000

Home …………..$200,000 Personal Property ……………….$20,000

Mortgage …..<$160,000> ……..$40,000 Net Worth ……………………..$100,000

Vehicles ………….$20,000 Life Insurance (husband) ……$50,000

Auto Loans ….<$10,000> ……..$10,000 Total Estate ……………………$150,000

Family Background:

- Married couple, three children under ten

- Husband works in sales, has good health insurance and a 401(k) program

- Wife stays at home raising children and has minimal lawsuit exposure

- The family lives in a state with $20,000 homestead protection for their personal

residence

Analysis:

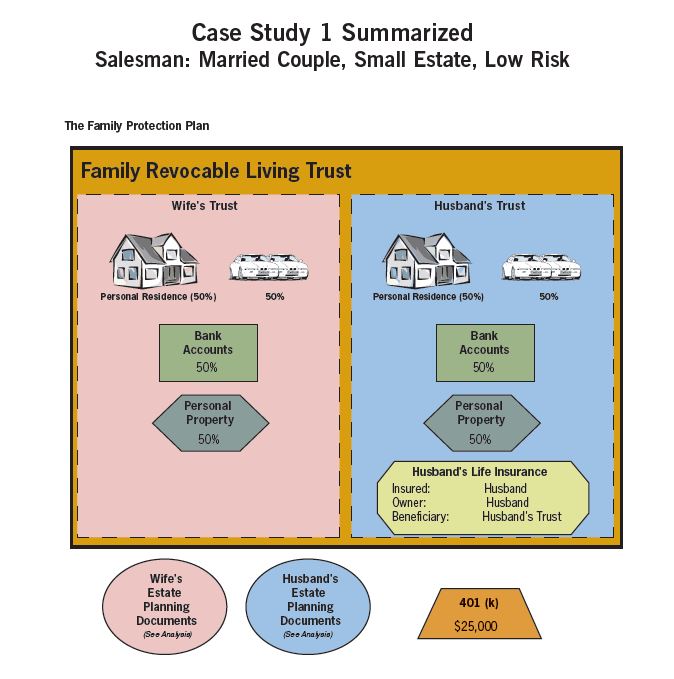

Family Revocable Living Trust – The Family Trust documentation consists of

two separate trusts (i.e. the Husband’s Trust and the Wife’s Trust). Assets maybe

assigned and/or titled in the name of either spouse’s trust, or they may be titled

in the name of the Family Trust, which splits the assets 50/50 between the two

trusts.

Personal Residence – The home is placed into the Husband’s Trust and the Wife’s

Trust for estate planning purposes. The family has good homeowner’s insurance with

a personal umbrella liability rider. The couple feels that with the minimal equity

and homestead protection, combined with good homeowner’s and auto insurance,

no additional entity is required to protect the home. (Note: For additional asset

protection, many advisors would consider placing the personal residence in a Limited

Partnership.)

Bank Accounts – Standard savings and checking accounts. Perhaps there is not

sufficient value in the accounts to warrant the superior asset protection of a Limited

Partnership for their safe assets. Splitting the bank accounts and home between the

two trusts will provide some asset protection from lawsuits generated against one

spouse.

Wife’s Trust – Wife’s Trust owns half of the family home and half of the couple’s

vehicles, which are adequately insured. Her trust also owns half of the bank accounts

and half of the personal property. In addition to the wife, the husband and children

are listed as the beneficiaries of the Wife’s Trust.

Husband’s Trust – Husband’s Trust owns half of the family home and half of the

couple’s vehicles, which are adequately insured. (Note: Frequently, some advisors will

place the wife’s auto in her trust and the husband’s auto in his trust.) Husband’s Trust

owns half of the bank accounts and half of the personal property. In addition to the

husband, the wife and children are also the beneficiaries of the Husband’s Trust.

Life Insurance – In a small estate, a husband’s life insurance policy typically

provides that the husband is the owner and the Husband’s Trust is the beneficiary.

At the husband’s death, the insurance company pays the insurance to the trustee of

the Husband’s Trust to distribute as outlined in his Living Trust.

401(k) – The 401(k) is a separate trust and works independently from the Living

Trust. The couple’s plan meets the requirements of ERISA and provides some asset

protection. The 401(k) lists the husband and the wife as the beneficiaries, with

the Husband’s Trust as a contingent beneficiary in case both spouses die leaving

surviving children/heirs.

Additional Estate Planning Documents:

Last Will and Testaments – A separate Last Will and Testament is created for each

spouse. The Will provides for the guardianship of the minor children in the event

of the parent’s death and provides a pour-over provision so those assets that are not

in the trust at the time of death are subsequently poured over to the trust after

probate.

Living Will – A separate Living Will is prepared for each spouse specifying the

individual’s desires to be kept on artificial life support if he or she becomes permanently

unconscious.

Springing Durable Power of Attorney – a separate document is prepared for each

spouse, naming and permitting an attorney, in fact, to act (or spring into action)

upon the disability or incapacitation of the individual. Each spouse names each

other to manage their financial affairs, with a successor listed if the spouse is

unwilling or unable to perform their duties. The form contains special HIPPA

provisions allowing enough access to medical records to establish incapacitation

has occurred.

Medical Power of Attorney – A separate Medical POA is prepared for each spouse

designating the other spouse to make important health care decisions if they

become incapable. A successor is named and the document contains HIPPA

provisions allowing access to the individual’s medical records.